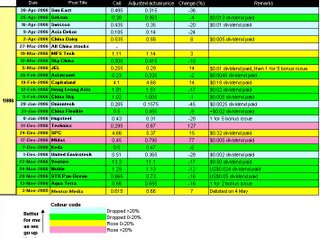

Acid test 1H06: Stock Performance 0 comments

Assessment of 1H06 stock picks

Assessment of 2H05 stock picks

(P.S: Click on the picture to get a better view

My first review of my hot-stock-not picks was at the end of 2005 where I reviewed my hotstocknot picks from May 05 to Oct 05. Here is the 2nd instalment; I do it half-yearly. The first list above is the list of stocks from Nov 05 to April 06 -- labelled 1H06 Assessment.

At the same time, since my medium term definition is from 6 months to 1 year, I also return to the May-Oct 05 picks and assess their performance over the past one year. That is the second list -- labelled 2H05 Assessment.

The colour codes remain the same, but while the mark of excellence is the 20% threshold for half-year comparisons (1H06), it becomes 40% for full-year comparison (2H05). The scale is slightly different. As before, I concentrate on total return --- the price plus incorporation of all dividends during the period in question, as well as any stock splits/bonuses.

1H06 Summary

Blue: 6 stocks

Green: 11 stocks

Yellow: 6 stocks

Red: 2 stocks

Just a quick review: my 1H06 picks have all been rather "good" as evidenced by the high number of blue and green shades (total 17 out of 25), with only a few yellow-coded stocks gaining slightly upon my reference price and two stocks throwing egg in my face: Midas and Technics. This might be because of the recent market correction; regular readers will note that at the height of the bull market around April to early May most of my picks were probably way above their reference prices.

There is one stock entry which I can't review, and that is "All China stocks" --- not shaded. I only started my China Stock Index in June, but I noted in my hot-stock-not entry during late March that it would be clear to all when the China fever died down. And so it did.

2H05 Summary

Blue: 2 stocks

Green: 12 stocks

Yellow: 9 stocks

Red: 5 stocks

As for the one-year picks (2H05) which I revisit, the results may perhaps be not that good. Remember that the threshold of excellence is 40% for this one-year assessment. My "good" picks number 14 out of total 28 --- a success rate of 50%. And there are 5 stocks which have risen way above expectation: Advanced, Pearl Energy, Mediaring, Pine Agritech, China Paper. To this, I say: sorry if you heeded my call, and perhaps next time you can use my blog for another purpose: to scout for potential multi-baggers :-p

Again, at the end of the day, the above comparison has just been an academic exercise or an exercise in personal vanity/personal humiliation. The stocks I have discussed would have done better or worse at various times during the last few months due to price fluctuations so such a static snapshot comparison somehow takes the dynamics out of things. Yet the key risks (industry, company, valuation) to the particular stock are still there and these should be what I hope to highlight and bring across in my blog articles. At the end of the day I still hope for the rising tide to continue despite its probable negative action on my "anti-portfolio"; for after all, it's likely to have positive action on my real stock portfolio.

0 Comments:

Post a Comment

<< Home