Acid test 2H06: Stock Performance 2 comments

(P.S: Click on the pictures to get a better view)

As per my previous review of my hot-stock-not picks in June 06, I review two lists of the stocks: the more recent picks from May-Oct 2006, labelled 2H06 Assessment, and the picks slightly further back from Jan-Apr 2006, labelled 1H06 Assessment. This constitutes my medium-term horizon where I typically judge the performance of my picks.

The colour codes remain the same, but while the mark of excellence is the 20% threshold for half-year comparisons (2H06), it becomes 40% for full-year comparison (1H06). The scale is slightly different. As before, I concentrate on total return --- the price plus incorporation of all dividends during the period in question, as well as any stock splits/bonuses.

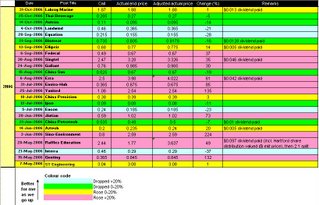

Assessment of 2H06 stock picks

2H06 Summary

Blue: 4 stocks

Green: 6 stocks

Yellow: 5 stocks

Red: 10 stocks

A bad half-year for me in terms of my HotStockNot picks, if I may say so myself. Brings me crashing down to earth after the last 1.5 years where my Hotstocknot picks have generally been quite good. Out of 25 stockpicks for 2H06 (ending Oct 06 since Nov-Dec 06 are too recent to judge properly), 10 stocks defied my prediction to end up >20% above the price at which I made the call. And quite a number have done exceedingly well, led by Sino-Environment, Genting and Yanlord which all recorded >100% gains. Stocks like Enviro-Hub, Jiutian and Ezra have also come into prominence, recording >50% gains.

One observation from these outperformers is that it has been detrimental to defy the fundamental underlying trends in selecting hotstocknots, whether it is the recycling theme (typified by Enviro-Hub) which is attracting big money, the O&G support theme (typified by Ezra and Federal), the China environmental protection theme (typified by Sino-Environment) or the China education theme (Raffles Education). Judgment on the basis of valuation risk is simply not adequate when sector growth story continues to be intact and market liquidity is flush. This half-year has been one of growth stocks and growth themes, and on retrospect, I might have been better off calling hotstocknots on laggard sectors facing headwinds (rising raw material prices, slowing demand) like the plastics and technology sectors.

The generous reader might also consider that given the surging upward momentum in the STI over the last half-year, anything less than a 20% total return for a particular stock would be considered an underperformance --- in which case I would have 15 stocks for and 10 stocks against. The cynical reader will observe that if he had held a portfolio of these hotstocknot picks, he might just have done quite well for himself instead, on the sole basis of those 10 red-coded stocks that have left me with egg on my face.

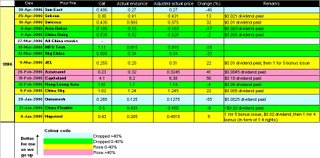

Assessment of 1H06 stock picks

1H06 Summary

Blue: 2 stocks

Green: 6 stocks

Yellow: 5 stocks

Red: 2 stocks

A relatively balanced spread. Remember that the threshold return for colour coding is set at +/- 40% since this stocklist is further back.

In the general scheme of things, it has been unwise to call hotstocknots on government-linked companies, as I have found in Capitaland, Singtel, Starhub and Singpost. These are companies with stable businesses and one must not underestimate the amount of growth they can generate from government contacts, as well as the amount of market support they often derive by virtue of their government links. I have found only limited success in highlighting certain GLCs such as Chartered Semiconductor and SPC, which face headwinds that not even (limited/tenuous) government linkages can resist.

A special note of mention: China stocks which were downgraded as a group in late March 06. Although there is no specific measure since my China Stocks Index only began in June 06, it was clear that they have declined or at least lost significant momentum since the heady early months of 2006. So I claim victory there, though it was probably pretty obvious to many that the way the China stocks were rising in March was plainly unsustainable.

The performance of my hotstocknot picks for 2H06 in particular has shown the danger of shorting stocks in a rising bull market. Even if one feels valuation is too stretched, the market might not agree and instead might go for the growth story without discounting the valuation or underlying business risk. Nevertheless, I will continue to highlight hotstocknot stocks where I feel the balance is not right --- but will try to show a greater sensitivity for market tendencies/preferences.

2 Comments:

From your experience, can you just try to pick some penny stock that will be mover in this 6months 2007?

Anonymous if you can provide your identity and your e-mail address I can communicate with you via e-mail. Rgds.

Post a Comment

<< Home