China Sun @ 82.5 cts ( Corn refining / China ) 1 comments

Final Poll Results: 9:8

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Main issues

1.Raw material risk might escalate

2.Unattractive compared to peer

3.Upside of fuel ethanol licence probably priced in

China Sun is one of the market leaders for the hot China theme and this has brought both institutional and retail investors (in that chronological order) into the stock over the past year, charging its surge over 1Q06. It has recently received favourable coverage from foreign brokerages (Merrill Lynch I think, that of Beauty China fame) which has enabled it to rebound to a similarly high level following the May market correction.

Yet I cannot see the attraction of this stock at this price level. People are buying in on the hope of the company winning a fuel ethanol production licence but the re-rating over this past year should surely have priced in the possibility, such that the downside from a failure to win the licence (which I believe is very possible ----the failure to win it, I mean) is greater from any upside in actually securing it. The dividend yield at its current price is a measly 1%. Compare it to a peer -- HKEx-listed China No.1 corn processor Global Biochem which is trading at 12X FY05 PE and has been exhibiting margin pressure as shown in its FY05 results (part of it due to unfavourable selling prices). China Sun is trading at 13.5X FY05 PE, and is seen as the fourth largest corn processor in China.

Global Bio-Chem is of course a more integrated corn processor which utilises a large portion of its in-house refined corn starch to produce higher value-added bio-chemical products, while China Sun's processes appears to end at the refining stage (ie. less vertically integrated), with ~60% production capacity in corn starch production and 40% in higher value-added items (in particular modified starch), with clientele in a diversified range of industries such as the paper manufacturing, food processing, textile, pharmaceutical industries. Nevertheless, the margin pressure is likely to extend to China Sun as well, and in this case the pressure comes from its input -- corn. This is the prime concern.

In some ways my analysis of China Sun is reminiscent of an earlier assessment of SPC. Both are refiners of a commodity whose downstream product demand constitute necessities in many industries, which leaves upstream input supply-demand dynamics as the key factor in determining margins. "Refining margins" are good so long as there is a demand-pull situation, but where cost-push situations arise (ie. high input prices unable to be compensated by higher end product prices) refining margins are squeezed.

An assessment of the quarterly gross margins of China Sun reveal its sensitivity to corn prices. The gross margin series is as follows:

Period: 2Q06 1Q06 4Q05 3Q05 2Q05 1Q05 4Q04 3Q04 2Q04

GM(%) : 33.3, 35.2, 34.6, 33.2, 37.8, 40.3, 40.3, 27.8, 31.1

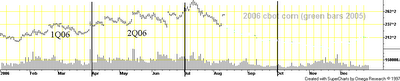

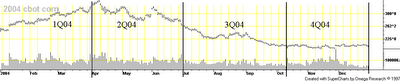

A series of corn price charts from 2004-06 taken off CBOT (Chicago Board of Trade) is shown below for comparison:

In early-mid 2004 when corn prices were above 260 (peaking above 300) China Sun's gross margins were squeezed, even hitting below 30% in 3Q04. In 4Q04 and 1Q05 it recovered phenomenally to 40% because corn prices had dropped to 210 and remained at that level until mid-2005 when corn prices started appreciating to above 240; 2Q05 and 3Q05 gross margins were crimped. Again towards the end of the year corn prices corrected downwards allowing margin recovery for China Sun, but as we have seen in 2006 so far the whole cycle has repeated as gross margins have crimped due to corn prices rising again (at around 240 at last count). The 2Q06 results have seen further gross margin crimp at 33.3%, a possible reason why the share price has dropped today despite endorsements from several brokerages.

It is not surprising that China Sun's gross margin, and ultimately net profit margin, is so susceptible to corn prices. Corn kernel forms 70% of total direct material cost, which in turn forms 80-90% of total direct costs. Direct costs form 95% of total operating costs (overheads are negligible). Do the maths and you'll find that basically corn kernel accounts for 55-60% of total operating costs. At pre-tax profit margin of ~30%, every 10% rise in corn prices will drop China Sun's pre-tax profit by ~15%.

Think about it. Corn is now seen as the most viable agricultural resource for producing fuel ethanol after sugar-cane (supply is even tighter to the extent that sugar prices have escalated), and an example can be found in crude palm oil where an alternative use in biodiesel has seen prices soar to the extent that its incumbent user, the edible oils market, is poised to see a "sea change in demand structure" and "significant inventory destabilisation" (see my article on the biodiesel boom)--- basically, it will be badly affected by rising prices of its key raw material. That is what would happen to corn refiners whose key raw material might see a paradigm shift in demand and hence price adjustment. This is not going to be a cyclical phenomenon; it will be a structural upward shift.

Add that to the abovementioned price sensitivity of China Sun's profits to corn prices and it would not be difficult to see this key risk. It is ironic that what is touted as the company's key attraction --- its possibility of exposure to fuel ethanol --- could also trouble its core business through the process of raw material cannibalisation. It will be even worse if the company fails to secure the fuel ethanol licence. Perhaps that might explain why the fund managers who bought into this earlier are not going in the stock for the long haul (eg. Legg Mason sold below 5% already).

References:

(1) TFC Commodity Charts

1 Comments:

Excellentissime

Post a Comment

<< Home